Are you dreaming of owning property in the breathtaking desert oasis of Palm Springs? As you embark on your homebuying journey, you might encounter a unique concept: purchasing a property on leased land. In this blog post, we’ll explore buying property on leased land in Palm Springs, providing valuable insights to help you make an informed decision. We’ll explore the fascinating history of leased land, its impact on property value, the enticing financial benefits, taxation considerations, transferability, mortgages, and important disclosures.

Understanding Indian Lease Land vs. Fee Simple Land:

In the realm of real estate, it’s essential to understand the distinction between Indian lease land and fee simple land. While fee simple land ownership is more common throughout the United States, Indian lease land presents a unique alternative, particularly in the Palm Springs area.

Fee Simple Land:

When you own property on fee simple land, you have complete ownership rights over both the land and any structures or improvements on it. This is the most common type of land ownership in the United States. As a fee simple landowner, you have the freedom to use, develop, sell, or transfer the property as you see fit, within the bounds of local regulations.

Indian Lease Land:

USA Map

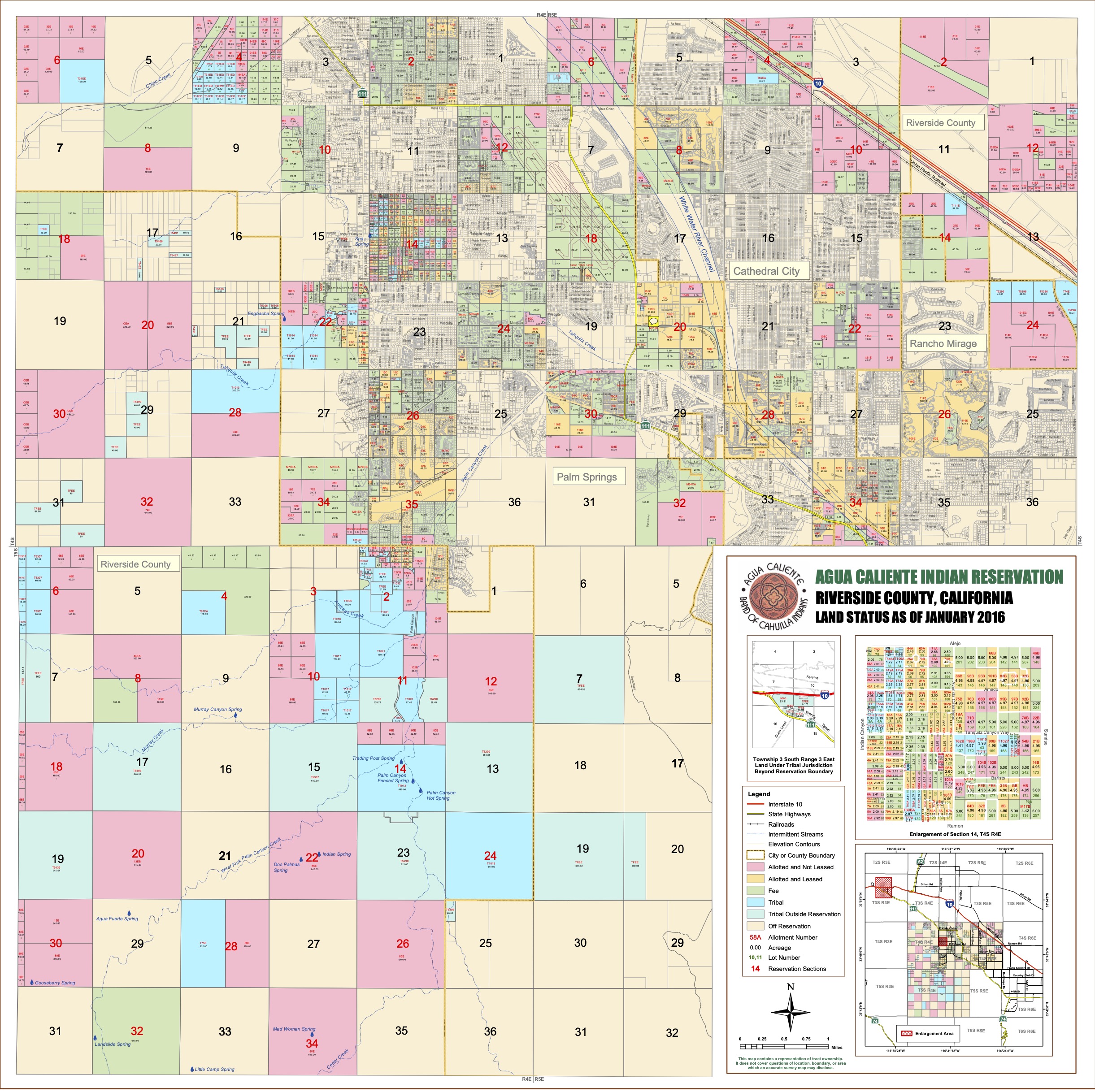

In certain regions, such as Palm Springs, you may come across Indian lease land. This type of land ownership emerged from historical agreements between the U.S. government and Native American tribes. The Agua Caliente Band of Indians holds ownership rights to significant land portions in Palm Springs, Cathedral City, & Rancho Mirage among other parts of Riverside County. When you buy property on Indian lease land, you own the structures or improvements on the land, but not the land itself. The land remains under the ownership of the tribe, and you enter into a long-term lease agreement to occupy and use the land for a specified period. Lease terms can vary, but they typically span several decades with most renewed leases being for 99 years, providing homeowners with the stability and security necessary for enjoying their properties. These leases are commonly negotiated and renewed well before their expiration dates, ensuring a seamless transition for homeowners and a harmonious relationship with the tribe. It’s important to note that Indian lease land ownership is governed by specific regulations and guidelines. The Bureau of Indian Affairs (BIA) or appointed property management companies administer most Indian land leases. Homeowners interact primarily with the lease administrators, who handle rent collection, lease renewals, and other administrative aspects of the lease agreement.

Comparing Indian Lease Land and Fee Simple Land:

One of the primary distinctions between Indian lease land and fee simple land is the ownership of the underlying land itself. In fee simple land ownership, you have complete control over the land, allowing you to make decisions regarding its use and potential future development. On the other hand, Indian lease land ownership grants you the right to occupy and use the land for the duration of the lease, but the land itself remains under the ownership of the tribe. While fee simple land ownership offers maximum control and flexibility, Indian lease land presents its own set of advantages. Properties on leased land, including Indian lease land, often come with a lower purchase price compared to fee simple land properties. This affordability can make owning a home in desirable areas more accessible for potential buyers.

One of the primary distinctions between Indian lease land and fee simple land is the ownership of the underlying land itself. In fee simple land ownership, you have complete control over the land, allowing you to make decisions regarding its use and potential future development. On the other hand, Indian lease land ownership grants you the right to occupy and use the land for the duration of the lease, but the land itself remains under the ownership of the tribe. While fee simple land ownership offers maximum control and flexibility, Indian lease land presents its own set of advantages. Properties on leased land, including Indian lease land, often come with a lower purchase price compared to fee simple land properties. This affordability can make owning a home in desirable areas more accessible for potential buyers.

Coachella Valley Indian Lease Land History:

To truly appreciate the significance of leased land in Palm Springs, we look back at the history that shaped the Coachella Valley as we know it today. The story of Indian lease land dates to the late 1800s, during the era of westward expansion and the construction of the Pacific Railroad. In 1876, as the Pacific Railroad began laying tracks between Los Angeles, CA, and Yuma, AZ, the U.S. government took possession of all the land along the railroad route. The government then granted the Pacific Railroad “checkerboard parcels” of every other square mile of land, extending for 10 miles on either side of the railroad right-of-way. This unique land distribution pattern created a patchwork of ownership throughout the Coachella Valley. The non-Railroad land, including the beautiful landscapes of Palm Springs, was deeded to the Agua Caliente Band of Indians by the government. This grant limited their ownership rights to 52,000 acres of the Coachella Valley, with 6,700 acres specifically encompassing the Palm Springs area. The establishment of Indian lease land in the Coachella Valley was a result of this historic land distribution. The Agua Caliente Band of Indians, as the rightful owners of the land, decided to enter long-term leases with individuals and entities interested in developing properties within their designated areas. These leases have been thoughtfully negotiated and renewed over the years, ensuring a stable and secure environment for homeowners and businesses alike. The agreements are often made well in advance of their expiration dates, providing a sense of reassurance to those investing in leased land properties. Today, the Coachella Valley stands as a testament to the unique blend of cultural heritage, natural beauty, and vibrant community spirit. The presence of Indian lease land has become an integral part of the region’s identity, contributing to the diverse tapestry that makes Palm Springs and its surroundings so captivating.

To truly appreciate the significance of leased land in Palm Springs, we look back at the history that shaped the Coachella Valley as we know it today. The story of Indian lease land dates to the late 1800s, during the era of westward expansion and the construction of the Pacific Railroad. In 1876, as the Pacific Railroad began laying tracks between Los Angeles, CA, and Yuma, AZ, the U.S. government took possession of all the land along the railroad route. The government then granted the Pacific Railroad “checkerboard parcels” of every other square mile of land, extending for 10 miles on either side of the railroad right-of-way. This unique land distribution pattern created a patchwork of ownership throughout the Coachella Valley. The non-Railroad land, including the beautiful landscapes of Palm Springs, was deeded to the Agua Caliente Band of Indians by the government. This grant limited their ownership rights to 52,000 acres of the Coachella Valley, with 6,700 acres specifically encompassing the Palm Springs area. The establishment of Indian lease land in the Coachella Valley was a result of this historic land distribution. The Agua Caliente Band of Indians, as the rightful owners of the land, decided to enter long-term leases with individuals and entities interested in developing properties within their designated areas. These leases have been thoughtfully negotiated and renewed over the years, ensuring a stable and secure environment for homeowners and businesses alike. The agreements are often made well in advance of their expiration dates, providing a sense of reassurance to those investing in leased land properties. Today, the Coachella Valley stands as a testament to the unique blend of cultural heritage, natural beauty, and vibrant community spirit. The presence of Indian lease land has become an integral part of the region’s identity, contributing to the diverse tapestry that makes Palm Springs and its surroundings so captivating.

To get a visual sense of the Indian lease land areas within Palm Springs, we invite you to explore our interactive map. This map showcases the specific locations where leased land properties are situated, providing you with a deeper understanding of the distinctive neighborhoods that define Palm Springs.

Today over 23,000 residential properties in the Coachella Valley are situated on Indian lease land, offering homeowners access to desirable locations and sought-after amenities. Each lease carries unique terms, lease owners, administrators, and statuses. It’s essential to delve into the specific terms of a lease, including its remaining duration and the parties involved. Most Indian land leases are administered by the Bureau of Indian Affairs or appointed property management companies. Some neighborhoods located on leased land include Indian Canyons, Tahquitz River Estates, Canyon View Estates, Sunrise Park, Deepwell Estates, Racquet Club Estates, & Twin Palms.

Does Indian Lease Land Impact Property Value?

Now, let’s address a common concern: the impact of Indian lease land on property value. Historical data indicates that properties on leased land in Palm Springs have experienced appreciation or depreciation rates similar to those of fee simple land properties. Property value is influenced more by factors such as condition, location, and market trends rather than the type of ownership. It’s important to remember that individual properties may vary, so thorough research specific to your property of interest is key.

Now, let’s address a common concern: the impact of Indian lease land on property value. Historical data indicates that properties on leased land in Palm Springs have experienced appreciation or depreciation rates similar to those of fee simple land properties. Property value is influenced more by factors such as condition, location, and market trends rather than the type of ownership. It’s important to remember that individual properties may vary, so thorough research specific to your property of interest is key.

Financial Benefits of Buying on Leased Land:

One of the most enticing advantages of purchasing property on leased land is the potential cost savings. Leased land properties generally have lower purchase prices, making homeownership more attainable. By owning the structure on leased land, you enjoy the benefits of the land without the significant capital investment required for fee simple land. Instead, you pay rent, as stipulated by the lease agreement, to the lease administrator. This approach opens up possibilities for affording a more luxurious home while maintaining a smaller initial capital investment.

Taxation Considerations:

Tax Forms

Another appealing aspect of leased land ownership is the potential tax benefits. Homeowners on leased land are typically taxed based on the market value of the structure, rather than including the underlying land. To understand the specific tax implications for your property, it’s advisable to consult with the Riverside County tax assessor.

Transferability and Mortgages on Lease Land:

When considering purchasing property on lease land, questions about transferability and obtaining mortgages often arise. Let’s delve into these topics to provide a comprehensive understanding of how transferability works and the availability of mortgages for properties on lease land.

When considering purchasing property on lease land, questions about transferability and obtaining mortgages often arise. Let’s delve into these topics to provide a comprehensive understanding of how transferability works and the availability of mortgages for properties on lease land.

Transferability of Lease Land Properties:

One of the common concerns for homeowners on lease land is whether they can easily transfer ownership of their properties. The good news is that the transferability process for lease land properties is like that of fee simple land properties. Homeowners on lease land have the same rights to sell or bequeath their properties as fee simple landowners. When you decide to sell your property on lease land, the process typically involves finding a buyer who is willing to assume the remaining lease term and comply with the lease agreement’s terms and conditions. Just like any real estate transaction, it’s important to work with a qualified real estate agent who understands the intricacies of lease land properties and can guide you through the transfer process.

Mortgages on Lease Land:

While it is possible to obtain a mortgage for a property on lease land, it’s important to note that the mortgage process can be more complex compared to fee simple land properties. Lenders often have specific requirements and conditions when it comes to financing properties on lease land. That’s why it’s crucial to work with a local lender who is familiar with the complexities of lease land transactions. When purchasing a home on leased land, make sure to speak with your lender to understand some of the additional closing costs that will be required, that are specific to land leases. Another important item of note is mortgages typically require at least 5 years to be left on the lease above the term of the mortgage. For example, a 30 mortgage requires at least 35 years left on the lease. If there are only 25 years left on the lease only a 15-year mortgage will qualify. Local lenders experienced in leased land mortgages understand the intricacies of lease agreements, lease terms, and the potential risks and benefits associated with lease land properties. They can guide you through the mortgage process, explain the specific requirements, and help you secure financing for your lease land property. It’s worth noting that some lease agreements may have down payment requirements or other specific conditions that lenders will consider when evaluating mortgage applications. By working with a knowledgeable local lender, you can navigate these requirements and ensure a smooth mortgage process. All most all mortgages on land lease require approval by the lessor so make sure you and your lender are prepared for the additional review timeline when submitting your offer.

While it is possible to obtain a mortgage for a property on lease land, it’s important to note that the mortgage process can be more complex compared to fee simple land properties. Lenders often have specific requirements and conditions when it comes to financing properties on lease land. That’s why it’s crucial to work with a local lender who is familiar with the complexities of lease land transactions. When purchasing a home on leased land, make sure to speak with your lender to understand some of the additional closing costs that will be required, that are specific to land leases. Another important item of note is mortgages typically require at least 5 years to be left on the lease above the term of the mortgage. For example, a 30 mortgage requires at least 35 years left on the lease. If there are only 25 years left on the lease only a 15-year mortgage will qualify. Local lenders experienced in leased land mortgages understand the intricacies of lease agreements, lease terms, and the potential risks and benefits associated with lease land properties. They can guide you through the mortgage process, explain the specific requirements, and help you secure financing for your lease land property. It’s worth noting that some lease agreements may have down payment requirements or other specific conditions that lenders will consider when evaluating mortgage applications. By working with a knowledgeable local lender, you can navigate these requirements and ensure a smooth mortgage process. All most all mortgages on land lease require approval by the lessor so make sure you and your lender are prepared for the additional review timeline when submitting your offer.

Remember, real estate transactions are complex and unique, so consult professionals experienced in leased land transactions for personalized guidance. With their support, you’ll navigate the process confidently, secure in the knowledge that you’re making a well-informed choice. Let the beauty of Palm Springs and the allure of leased land ownership guide you toward a home that fulfills your dreams and captures the essence of this extraordinary desert oasis.

Before venturing into a purchase on leased land or fee simple land, it’s crucial to carefully review all contracts, leases, and property-specific information. The information provided in this blog post serves as general guidance and should not be considered legal or tax advice. Seeking advice from financial advisors, tax experts, and legal counsel is essential to ensure a well-informed decision and smooth real estate transaction.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link